See This Report on Retirement Income Planning

Table of ContentsThe Single Strategy To Use For Retirement Income PlanningFascination About Retirement Income Planning

One usual misunderstanding is actually that retired life profiles are assured. This is actually not the scenario. While some courses supply insurance coverage for retirement life profiles, such as the FDIC for financial savings profiles and the SIPC for broker agents, these plans merely safeguard against reduction because of failure of the institution, not against loss due to market health conditions. Many consider their 401( k)a guaranteed retirement cost savings strategy. However sadly, that is

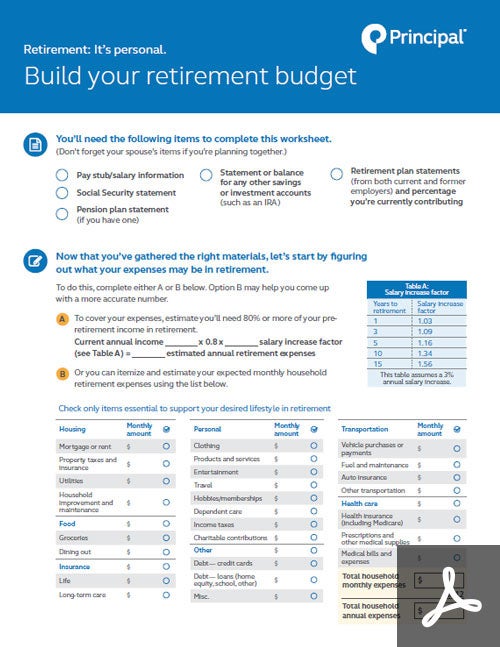

not the situation. A 401 (k)is actually an employer-sponsored pension that makes it possible for employees to add a section of their salary to a tax-deferred profile. The loan in the account can at that point be actually purchased numerous protections, such as assets, bonds, as well as mutual funds. The profile value will rise and fall depending upon the performance of the expenditures. For these explanations,

it is crucial to understand that a 401 (k)is actually certainly not an ensured pension - retirement income planning. Nevertheless, it may still be actually a beneficial device for creating your home egg. Pensions are actually usually ignored as retirement life preparing tools, however they deliver a number of special benefits that could be very important to senior citizens. Second, allowances are tax-deferred, so you will definitely certainly not need to pay normal profit tax on your assets till you acquire payments. Pensions deliver death benefits and matrimonial benefits that can assist to supply economic safety for your adored ones. For these causes, allowances are actually often thought about the best protected retirement life plan. If you are actually looking for a safe assets collection that are going to deliver an assured earnings stream, a pension check out this site with a life-time earnings rider is actually the technique to go. Using this kind of allowance deal, your settlements are ensured regardless of the length of time you live, so you may rest ensured that your retired life financial savings will certainly certainly never go out. Through this type of pension, your rate of interest is actually ensured for a set period of time, so you recognize precisely the amount of cash you'll get every year. If you are actually appearing for a financial investment that possesses the potential to develop over time, a predetermined mark annuity is actually the best selection for you. Mark annuities perform certainly her explanation not lose money to market volatility and should certainly not be actually puzzled with a changeable annuity (which can shed cash ).

Retirement Income Planning for Beginners

Whichever find out type of annuity you select, you can relax guaranteed that your retirement cost savings are risk-free and audio. When it happens to retirement preparation, there are actually a great deal of factors to look at. The computations generated may not be ensured yet will definitely offer a rough estimate of just how much revenue you may gather in the future.

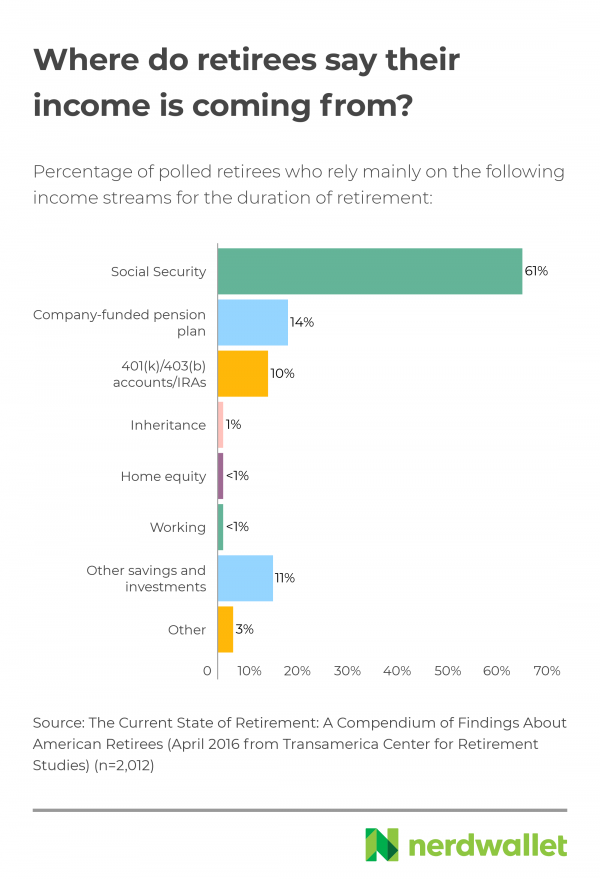

These workplace retirement life programs utilize a pension deal to deliver lifetime income to retired laborers. Pension account benefits can be a necessary retirement life profit source, as well as standard pension plan programs are typically one of the very most generous profit resources available. retirement income planning. There are actually an amount of inquiries that need to have to be addressed when you are actually considering retirement life earnings.